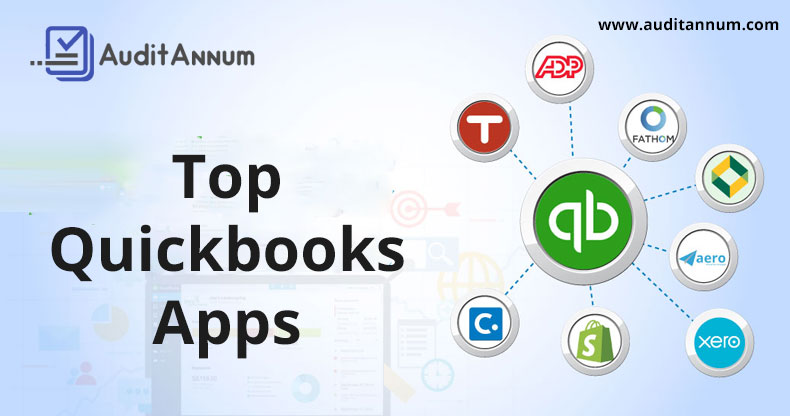

There are plenty of QuickBooks apps to choose from to provide automation to the many tasks done manually in QuickBooks Desktop or QuickBooks Online. The depth of QuickBooks app integration can inevitably overwhelm while you look for QuickBooks add ons & extensions to fill specific gaps encountered in recording transactions. Each business will have specific operational needs, requiring specific apps. While acknowledging this, here are apps providing immediate impact for ANY business in 2020. One of the most highly rated apps in the QuickBooks marketplace, that is TSheets offers a time tracking, payroll, and invoicing solution for teams that need a bit of help managing time and their employees’ time and pay. There’s a free version for single-person teams, so you can access it just to track your own processes.

1. TSheets (Robust Quickbooks Time Tracking)

TSheets by QuickBooks enables you to more easily and accurately track employee time. Depending on how you get set up, you will be able to conveniently track billable time or non-billable time, classes, service items for the type of work being done, and where the payroll-related items base salary, holiday, employee breaks and lunches, employee work notes, etc. It’s been especially helpful for us and many of us also take advantage of the mobile app available to monitor time spent on jobs, breaks or lunches, and transition among states in a timely manner tracking things by the minute.

2. Avalara AvaTax (Automated Sales Tax Calculation Amid Sales Tax Nexus)

Avatax by Avalara makes Sales Tax Item and Sale Tax Group in QuickBooks, QuickBooks Desktop, or QuickBooks Online significantly more manageable. Not only will that process be streamlined, but the AvaTax will help calculate Sales Tax collection, filing, and remittance.

The more important item of interest Avalara assists with is the determination of Sales Tax liability, with respect to interstate commerce, and whether or not your business has a physical presence in a sales tax-collecting state. The sales tax determination process received a little jolt in the minds of business owners. In short, for the time being, your business will keep track of the total revenue generated in a sales tax collecting and/or the number of transactions conducted therein.

3. QuickBooks Enterprise Advanced Pricing

If your business customer pricing strategy requires greater precision, take a deep dive into QuickBooks Advanced Pricing available to QuickBooks Desktop Platinum subscribers. It goes beyond Price Levels where you customize pricing by the customer type. Advanced Pricing avails your business the ability to set multiple pricing conditions:-

- Item-based conditions

- Customer-based

- Class-based

- Sales rep based

These conditions can also be strung together to set a comprehensive price rule, which is then added to your Price Rules List in QuickBooks Desktop Enterprise.

After establishing your starting point, you can set date ranges for your price rules:-

- When you want it to start

- When you want it to start

- When you want it to end

To finish the process, you’d set your price to be a percentage or an amount higher, or lower than base price or the cost at which you procure products or services.

4. Quickbooks Payment (Electronic Payment Process)

The Quickbooks records events but does not process them in real-time, like processing a credit card payment. With QuickBooks Payments, or what was Merchant Services, you could integrate them, along with ACH transactions, more seamlessly into QuickBooks Desktop, QuickBooks Online or QuickBooks Point of Sale linking them to the right customer and transaction. For some time now, your business can also take advantage of mobile card readers with QuickBooks Payments if it’s one of the on-the-go types.

From taking advantage of this comes a tighter invoicing and collection workflow, with customers receiving emails letting them view and pay invoices. This is made even tighter for QuickBooks Desktop users, thanks to its new Invoice Tracker where you can see the life of a customer invoice from its creation to its payment. Its Merchant Center is the place where your business can review the transactions processed through QuickBooks Payments purchases by customers or refunds to them.

5. Field Service Management

Real-time Fieldwork integration with QuickBooks Desktop or Online

Whether a sole proprietor or a larger scale business, field service management makes your business agile and adaptive. Establish work orders for services you provide:-

- Archive them in your QuickBooks company file,

- Link them to your invoicing and payroll processes

- Take them with you on the road

- Authorizing mobile payments through the accompanying mobile app

Your team will have the ability to schedule, assign or re-assign work orders by skills, availability, or customer location through an interactive dispatch board, tracking work statuses among your available technicians, ensure reliable transportation to job sites thanks to printable mapping and directional guidance via GPS and Google. Every detail or activity taken on the road will then sync back to your QuickBooks company file in your office customer list data, item list data, QuickBooks invoices, etc.

6. QuickBooks Advanced Inventory

More Detailed Inventory Management For Your Business

If your business needs to track inventory beyond quantity, cost/price, it can look to adding QuickBooks Advanced Inventory to your organization. With QuickBooks Desktop Enterprise Platinum Edition and enabling the feature, your business will be able to track quantities for inventory sites, bins/rows/shelves; by way of the serial number, or lot number; you will be able to change your costing method from Average Cost to First In First Out (FIFO), you will be able to catalog your items using barcode scanning. As far as costing or Cost of Goods Sold (COGS) is concerned and figuring out if your business needs to use one method over another, then refer to our inventory guide.

Over the last couple of versions especially with QuickBooks Desktop Enterprise 2020, the barcode scanning feature has received significant additions. Immediately coming to mind is wireless barcode scanning, where you can finally pull inventory for shipment from your warehouse or manufacturing plant; or, when it comes to inventory replenishment scanning products back into stock. To enhance the applicability of the feature, you can take advantage of fulfillment worksheets for both Sales and Purchase Orders. Warehouse personnel can update information within them using the mobile warehouse app and supported devices like the MC40 scanner. Those updates will then be reflected in your overall company file for QuickBooks Desktop.

7. Fishbowl Manufacturing / Wholesale

Taking Manufacturing and Warehouse Management to a Different Level

If your warehousing operations have grown larger and at a quicker pace than anticipated, it is likely you’ll want to have a conversation with your expert about integrating your QuickBooks company file with Fishbowl. If you come to a point where you squeezed everything out of Advanced Inventory in practice or research, your expert will determine if your needs are definitely met by taking advantage of Fishbowl.

Offhand, your business may need to use costing methods additional to First in First Out (FIFO) or average cost. A diverse set of workflows surrounding the Bill of Materials, Work Orders/Assemblies, Tracking Criteria, and the need to process Return Merchandise Authorization (RMA).

8. QuickBooks Cloud Hosting

Access QuickBooks from the Cloud without Reducing Functionality

Your business may be one of those who would like to access QuickBooks and your company file from the cloud. You also may have experienced, or know someone else who has, QuickBooks Online. It may or may not have been your cup of tea, needing something you are still used to and assured in what it can do for your business. With cloud hosting you can have the best of both worlds, accessing a fully integrated desktop environment in which QuickBooks Desktop can operate. What’s more, is your business can significantly improve its agility with users being able to work in any location having remote or internet access.

Cloud hosting providers will also do what they can to ensure compatibility with any supplementary add-ons for your QuickBooks company file. What’s more important regarding cloud hosting environments is the security and redundancy provided to your business. What’s also nice is if your existing computing equipment is needing an upgrade, or two, adoption of cloud hosting eliminates that concern entirely.

Conclusion

In this blog, we can provide you the top Quickbooks Apps. I hope this blog will help you to know the information about the top Quickbooks Apps. We can provide information about the top Applications of Quickbooks. So many QuickBooks apps and integrations with niche software like trucking accounting software exist, and innovations are being developed for QuickBooks all the time. For now, these are my favorites, but it’s important to stay up to date on what’s happening in the QuickBooks community.

If you want to make more efficient can transform your clients’ businesses then you must have to select the Quickbooks apps that can best automate the tasks. You will have long and happy customer relationships if you are creating mutual business success with your clients.

No Comments